colorado paycheck calculator adp

Colorado Salary Paycheck Calculator. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

Form 10 K Automatic Data Processin For Jun 30

Colorado hourly paycheck and payroll calculator.

. Colorado Paycheck Calculator Adp. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees w4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or. It should not be relied upon to calculate exact taxes payroll or other financial data.

23 Colorado Paycheck Calculator Salary IdeasCalculates federal fica medicare and withholding taxes for all 50 states. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator. Colorado Hourly Paycheck Calculator.

It should not be relied upon to calculate exact taxes payroll or other financial data. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. These calculators are not intended to provide tax or legal advice and do not represent any ADP.

Switch to Colorado salary calculator. Use adps colorado paycheck calculator to calculate net take home pay for either hourly or salary employment. Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator.

Important Note on Calculator. So the tax year 2022 will start from July 01 2021 to June 30 2022. Calculate how much your wages are after taxes.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. It should not be relied upon to calculate exact taxes payroll or other financial data. Overview of colorado taxes colorado is home to rocky mountain national park upscale ski resorts and a flat income tax rate of 45.

Ad Payroll So Easy You Can Set It Up Run It Yourself. If your employer offers such benefits think about. Next divide this number from the annual salary.

Colorado tax year starts from july 01 the year before to june 30 the current year. This link calculates gross-to-net to estimate take-home pay in all 50 states. Calculate Paycheck Colorado.

So the tax year 2021 will start from July 01 2020 to June 30 2021. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculator with convert Payment Update calculate paycheck colorado.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income. 2 of every of your own paychecks is withheld for Social Security taxes as well as your boss contributes another 6th. Important Note on Calculator.

Subtract any deductions and payroll taxes from the gross pay to get net pay. It determines the amount of gross wages before taxes and deductions that are withheld. Free Colorado Payroll Tax Loan Calculator And Co Tax Rates.

Over 900000 Businesses Utilize Our Fast Easy Payroll. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Important note on the salary paycheck calculator.

So the tax year 2021 will start from july 01 2020 to june 30 2021. Calculate Your Internet Pay Or Take Home Pay By Entering Your Per. All Services Backed by Tax Guarantee.

Switch to Colorado hourly calculator. Use adps colorado paycheck calculator to calculate net take home pay for either hourly or salary employment. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

Are you looking for calculate paycheck colorado. Figure out your filing status. Use this Colorado gross pay calculator to gross up wages based on net pay.

Calculate net salary and tax deductions for all 50 states in the free paycheck calculator payroll calculator is a free quick and easy online paycheck. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. By Hafsa Molla - 9 August 2022.

Learn more about the particular senior executives who are leading ADPs business. These calculators are not intended to provide tax or legal. This colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Salary Paycheck Calculator-By ADP.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Oregon Paycheck Calculator Adp

Complaint For Permanent Injunction And Other Equitable Relief

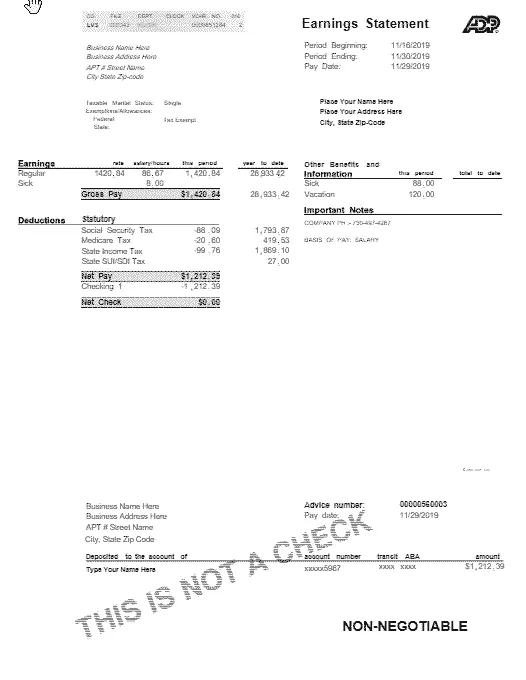

Pay Stub Copy Generator Pdfsimpli

Hourly Paycheck Calculator Calculate Hourly Pay Adp

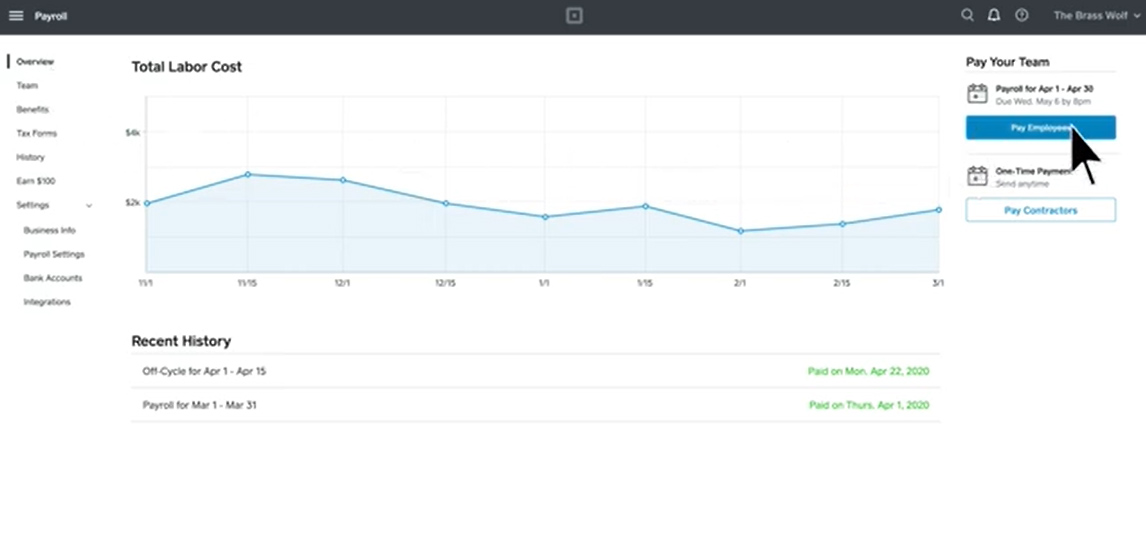

10 Best Small Business Payroll Software For 2022

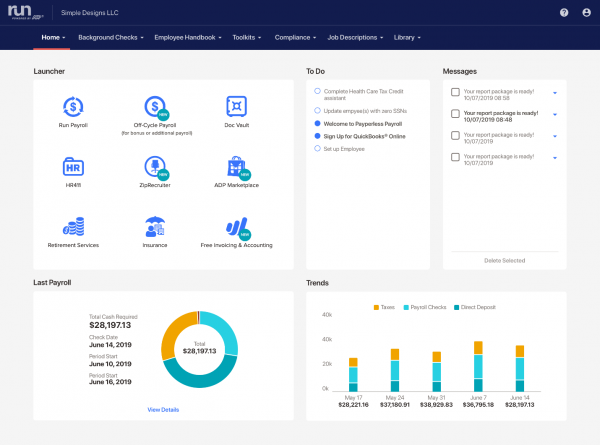

Run Powered By Adp Payroll Review Cost Features Alternatives Nerdwallet

How To Do Payroll Yourself In 8 Steps Youtube

Adp Delivers A New And Engaging User Experience For Adp Vantage Hcm R

Colorado Paycheck Calculator Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp